Scaling Smarter: Funding Hurdles Start-Ups Must Overcome To Grow

May 13, 2025

Securing early capital is only the beginning for most start-ups. As a company gains traction, scaling introduces a new set of financial challenges that can determine long-term viability. Many founders find that moving from seed stage to sustained growth is a much steeper climb than anticipated. Without careful financial planning and a diversified funding strategy, even the most promising start-ups risk stalling during expansion.

Key Takeaways on Funding Hurdles Startups Face

- Scaling requires more than seed success: Moving from early funding to sustainable growth demands a solid financial strategy and deeper investor trust.

- Investors want traction, not just vision: As funding rounds grow, so do expectations for revenue, user growth, and clear paths to profitability.

- Rapid growth pressures can backfire: Chasing fast expansion often leads to overspending and operational strain without the right systems in place.

- Funding access isn’t equal for all: Geography, sector, and founder background can affect how easily start-ups connect with capital networks.

- Trending sectors attract but challenge: High-interest areas like clean tech offer funding opportunities but also involve strict validation and compliance standards.

- Capital strategy is key to resilience: A mix of equity, debt, and partnerships—backed by sector-specific guidance—supports smarter, steadier growth.

- Clarity and pacing beat hype: Founders who align funding with realistic milestones are better equipped to maintain momentum and scale successfully.

Register Your LLC

Company Registration

START NOWThe Shift from Seed to Scale

Initial funding rounds often focus on proving a concept or developing a minimum viable product. Once a start-up reaches the point of market validation, scaling requires significantly more capital to expand, hire, enter new markets, or enhance. This shift typically demands larger funding rounds, but many investors grow cautious at this stage. They want evidence of traction, unit economics, and clear pathways to profitability. Founders who relied heavily on early excitement may struggle to meet these rising expectations without the right financial foundation.

Pressure to Show Rapid Growth

Start-ups aiming to scale quickly are often under intense pressure to show revenue spikes and increased user engagement within short timeframes. That urgency can lead to overspending, hiring too quickly, or overextending resources before systems are ready to handle growth. Investors want to see scale but also expect operational discipline. Founders who do not clearly map out how funding will be used to meet specific milestones may find themselves turned down during later rounds.

Access to Capital is Uneven

Geographic location, industry focus, and the background of the founding team all play into how easily a start-up can raise money. Companies based in tech hubs may have better access to venture capital networks, while others may rely more on angel investors or government grants. For start-ups in less saturated sectors or outside major urban centers, connecting with the right financial partners can be more time-consuming and less predictable. This is particularly true for founders from underrepresented backgrounds, who may face additional barriers in securing equal access to funding.

Competing in Trending Sectors

Emerging sectors attract more funding attention but also come with heightened competition and expectations. For instance, start-ups investing in clean tech are drawing interest from institutional investors and government programs. However, the bar for innovation and scalability is high. Funding applications in these sectors often require complex technical validation, environmental impact assessments, and regulatory compliance.

Building Resilience Through Funding Strategy

Funding is not just about raising the largest round possible. A thoughtful capital strategy that blends equity, debt, grants, and strategic partnerships can offer better control and longer-term sustainability. Scaling founders should seek advisors who understand their sector in their growth stages. Rather than racing to the next round, success often depends on pacing, planning, and leveraging with intention.

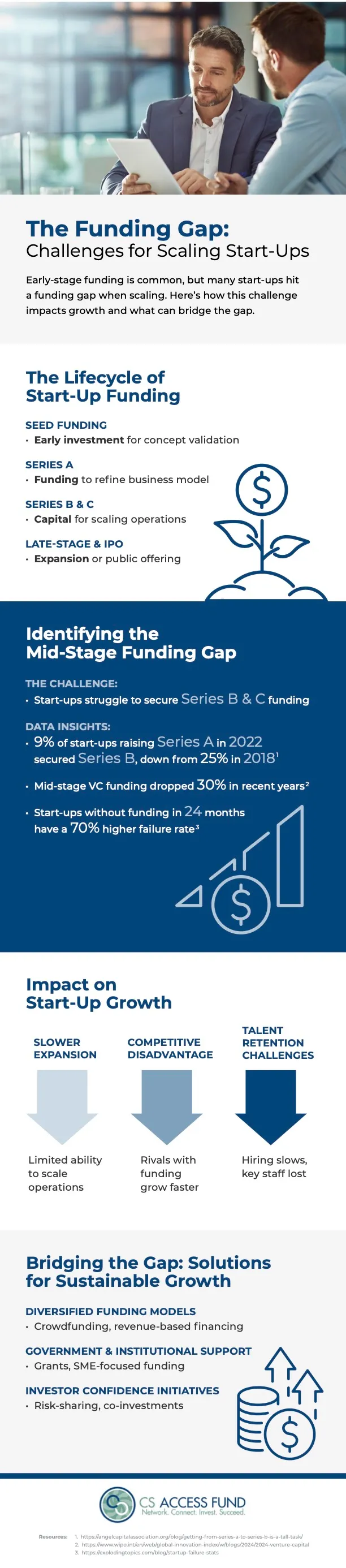

Growth-stage funding is a challenge that requires more than a great idea. It demands strategic discipline, investor communication, and a clear plan for how capital fuels expansion. Start-ups that approach funding with clarity and purpose will be far better positioned to turn momentum into measurable, lasting success. Check out the infographic below for more information.